Top 10 Tips On The Market For Rates And Currency Exchange Trends

Any person involved in travel, business or investment management needs to be aware of the market's trends. Market trends are the fundamental patterns of price movements and economic indicators over time. Market trends are influenced by a range of elements like geopolitical events, economic data and consumer behaviour. Being aware of market trends can help travelers optimize their budgeting and currency exchange. For companies, staying up-to-date with market trends can guide pricing and strategic decisions. Investors should use market trends to make informed choices when the purchase and sale of assets. Here are the top ten crucial tips to monitor and leveraging market trends to your advantage.

1. Keep up-to-date with economic indicators.

Economic indicators such as the growth of GDP, employment rates, inflation, and consumer confidence could significantly affect the market's trends. These indicators can offer valuable insight into the general state of the economy, as well as the possibility of changes in currency. Websites like those of the Bureau of Economic Analysis or Federal Reserve offer valuable data to help you comprehend market conditions.

2. Utilize Financial News Sources

Trustworthy financial sources, such as Bloomberg, Reuters, or CNBC offer the most up-to-date details on the latest market trends, news, and other factors that could affect different industries. Sign up to the market analysts' newsletters, and follow them on social media for the latest market announcements, economic forecasts and expert advice. This information can help you in your investment, business or travel strategies.

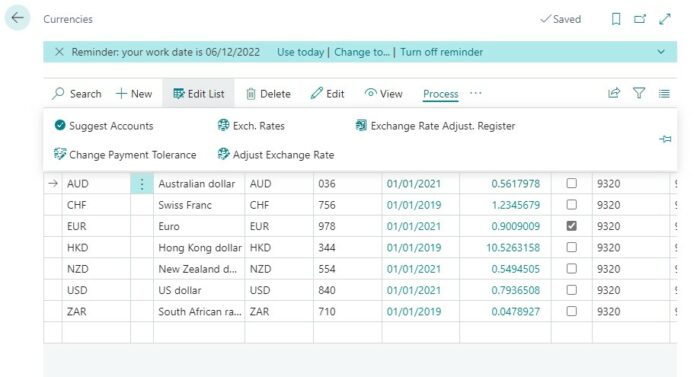

3. Leverage Online Analytical Tools

TradingView, MarketWatch, Yahoo Finance and various other analytical platforms provide historical market data, charts, technical analysis, which you can use to determine trends. You can utilize these tools to identify patterns and trends within the markets. This will allow you make more informed decisions about your trip, business or investment.

4. Understand the seasonal patterns

– Many markets experience seasonal fluctuations that impact prices and demand. Tourism can peak at certain times of the year which can impact demand for currencies and rates. Knowing the seasonal changes will allow you to plan your budget for travel more effectively or adjust your business strategies to keep up with the changing needs of consumers. For instance, if your exchange rates tend be more favorable off-peak, you may choose to time the exchange rate accordingly.

5. Geopolitical events are closely monitored

Geopolitical events like trade agreements, elections, and wars could influence the currency and market values. Keep up-to-date with global events, which could influence the areas you could be visiting, conducting business in, or investing in. A change in government policy may cause changes in the currency in a particular country, which could impact your investment or travel budget.

6. Make use of Social Media for Real-Time Updates

Twitter and LinkedIn, for example, offer real-time information about the latest financial and economic news. Follow industry leaders economists, financial analysts, and others to get their perspectives and insight into the market. Additionally, participating in relevant online communities can help you exchange information and stay informed about developments in the market that could influence your financial decision-making.

7. Review historical data to see trends

Historical data can offer valuable insight on how the markets have responded when faced by similar circumstances. Through studying historical trends it is possible to identify future patterns and make educated predictions about future movements. This can be a helpful method for investors who are trying to identify the long-term trends or for businesses that are searching for pricing strategies that are based on the behavior of consumers in the past.

8. Implement Trend Analysis in Your Strategy

Trend analysis is the process of analyzing historical price data to identify patterns and make predictions about future price movements. It is crucial to monitor changes in currency for travelers in order to know when it's best to exchange currencies. Trend analysis is helpful for companies to design pricing and marketing campaigns. Investors can use trend analysis to pinpoint entry points and exits for their investments.

9. Diversify the sources of your information

It is possible to get a misguided perception of market trends when you only rely on one source of information. Diversify sources by looking at different financial news outlets as well as online analytical tools as well as economic and business reports. Through gaining insight from a variety of perspectives, you'll be able to build a comprehensive knowledge of the market. This will enable you to make better choices.

10. Talk to Financial Advisors

Think about consulting with a financial professional should you have any questions regarding the market's current conditions and their effect on your financial goals. These professionals will offer you a personalised guidance based on the unique circumstances of your situation. They will also assist you create strategies to navigate market changes. Experts can assist you in establishing budgets, maximizing operations or managing a portfolio.

These detailed tips will help you navigate the complexity of travel, business and investment management more effectively. Understanding trends in the market will help you make better financial decisions, aligned with your business or personal objectives. This will ultimately improve your financial strategy. Read the most popular exchange rate for more info including canadian dollar to usd, usd to japanese yen, convert gbp to usd, dollar to php, rmb to dollar, aed to usd, swiss franc to usd, inr to usd, swiss franc to usd, euro usd and more.

Top 10 Tips On Destination Currency And Currency Exchange Rates

Understanding the destination currency of a country is important for those who conduct international business or executing the foreign exchange market. The currency of destination is the local currency of the country that you are traveling to, or with whom you are in engaged. It will affect your financial decision. Fluctuations of exchange rates, conversion fees and the general economic climate can impact how much you spend on travel or your business transactions. When you have an understanding of the destination currency, you will be able to make more informed financial decisions. The top ten tips on how to handle the currency of your destination are provided below.

1. Study the currency of the country Before Traveling

Learn about local currencies prior to traveling to another country. Learn the exchange rate of your currency compared to the rates of other countries, and find out the value of your currency. This will help you better manage your money and avoid paying excessively. Websites such as XE.com permit you to view the current exchange rate and previous data. This will allow you to determine what your money worth in foreign currency.

2. Check the exchange rates prior to Your Trip

The monitoring of these fluctuations can help you decide when to exchange money. To get alerts for advantageous exchange rates, make use of currency tracking software and apps. If you notice a trend in which the currency appears to be declining, you should consider changing your money earlier in order to increase your purchasing power during your trip.

3. Currency Conversion Costs to Consider

The charges that banks and exchange services and ATMs for currency conversion can vary greatly. Be aware of any fees that are associated with the conversion of your currency of origin to the currency you wish to use. They can quickly mount up. Check exchange rates with different providers, and use online platforms with low conversion costs and affordable rates.

4. Utilize local currency to make transactions

Pay in local currency when you make purchases overseas. Never use your home currency. When you use your currency from home you are often dependent on dynamic currency conversions (DCC) that can lead to more fees and less favorable rates of exchange. You may benefit from lower exchange rates if you pay using your local currency.

5. Plan to meet cash needs in advance

Even though debit and credit cards are widely used in many countries, it's essential to have some cash with you for small expenses or tips. It is also possible to require cash at places that do not accept cards. It's important to know ATM fees and limits for cash withdrawals when traveling abroad. Making larger withdrawals simultaneously can help cut down on transaction costs. Being prepared with local currency can make traveling simpler and less anxiety-inducing.

6. Understanding local payment options

Different countries have different payment methods. Certain countries are heavily influenced by cash, while others depend heavily on credit cards and digital payments. To know the most commonly used payment methods, study the local payment culture. This will help you plan your payments and ensure that transactions are conducted without any issues.

7. Risks of currency for businesses

If you are doing business in another country, keep your eyes open for the potential dangers of fluctuations in currency. Profit margins and financial performance could be affected by a sudden shift in the value of the currency of the destination. It is possible to use hedging techniques like forward contracts to safeguard against currency fluctuations and to lock in rates for future transactions.

8. Keep track of Your Spending

Be aware of your expenditure while on vacation in the currency of your destination. Track your spending by using budgeting apps or keeping an accurate list of every expense. You will be able to keep track of how much you spend in the local currency, and you will be able to avoid spending too much.

9. Financial Regulations: You Should Know Your Rights

– Different countries have various regulations regarding exchange of currency as well as cash transactions and reporting obligations. Be aware of these rules to avoid any legal problems when traveling or conducting business. Some countries may restrict the amount of money you can carry into or out of a country and others may require you declare large transactions. It is essential to stay informed about these regulations to be able to navigate these regulations without hassle.

10. Consult currency specialists for Investments

If you're watching investments in foreign markets, think about consulting with experts in currency or financial advisors who specialize in international investments. They can offer important insights into the effect the fluctuations in currency have on your portfolio of investments and can help you develop strategies to manage risk associated with currency. They can guide you through the complex world of destination currencies to optimize your financial results.

These detailed guidelines to manage the currency of your destination will help you navigate the many complexities of traveling conducting business, as well as monitoring your investments. Understanding the implications of destination currency will empower you to make better financial decisions that align with your objectives, ultimately improving your overall experience as well as your financial plan. Take a look at the recommended homepage for CZK to EUR for website advice including dollar to canadian dollar, dollar to won, cop to usd, convert pounds to dollars, usdthb, usd to jpy, usdthb, us dollar to pakistani rupee, usd to rmb, yen to usd and more.